Mastering Forex Risk Management: Your Key to Consistent Profits

Learn forex risk management strategies to enhance your trading success. Explore now!

Mastering Forex Risk Management: Your Key to Consistent Profits

Are you tired of inconsistent trading results? Do you feel like something is missing in your strategy? The answer might lie in your risk management approach. Mastering forex risk management is not just an option; it's a necessity for any trader aiming for consistent profits.

TL;DR: Key Takeaways

- Effective risk management is crucial for consistent trading success.

- Position sizing determines the potential risk of each trade.

- Utilizing risk-reward ratios helps in setting realistic trade targets.

- Managing drawdowns can protect your trading capital.

- Diversify your portfolio to minimize risk exposure.

Introduction to Forex Risk Management

In the fast-paced world of forex, risk management is the cornerstone of sustainable trading. But what does it truly entail? At its core, forex risk management is the process of identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize, monitor, and control the probability or impact of unfortunate events.

Effective risk management allows traders to protect their capital while maximizing their potential gains. It involves a strategic combination of technical and fundamental analysis, position sizing, and emotional discipline.

Understanding Position Sizing

Position sizing is the first step in risk management, determining how much money you will allocate to a single trade. Proper position sizing helps limit your risk to a predetermined level, usually a small percentage of your trading capital.

For example, if your account balance is $10,000 and you decide to risk 1% per trade, your maximum loss per trade would be $100. This way, even if the trade goes against you, your account will not suffer a significant hit.

Calculating Position Size

To calculate position size, you need to know:

- The distance to your stop-loss in pips

- The dollar amount you are willing to risk per trade

- The pip value of the currency pair

Here's a simple formula to calculate position size:

Position Size = (Account Risk in $) / (Stop Loss in pips × Pip Value)

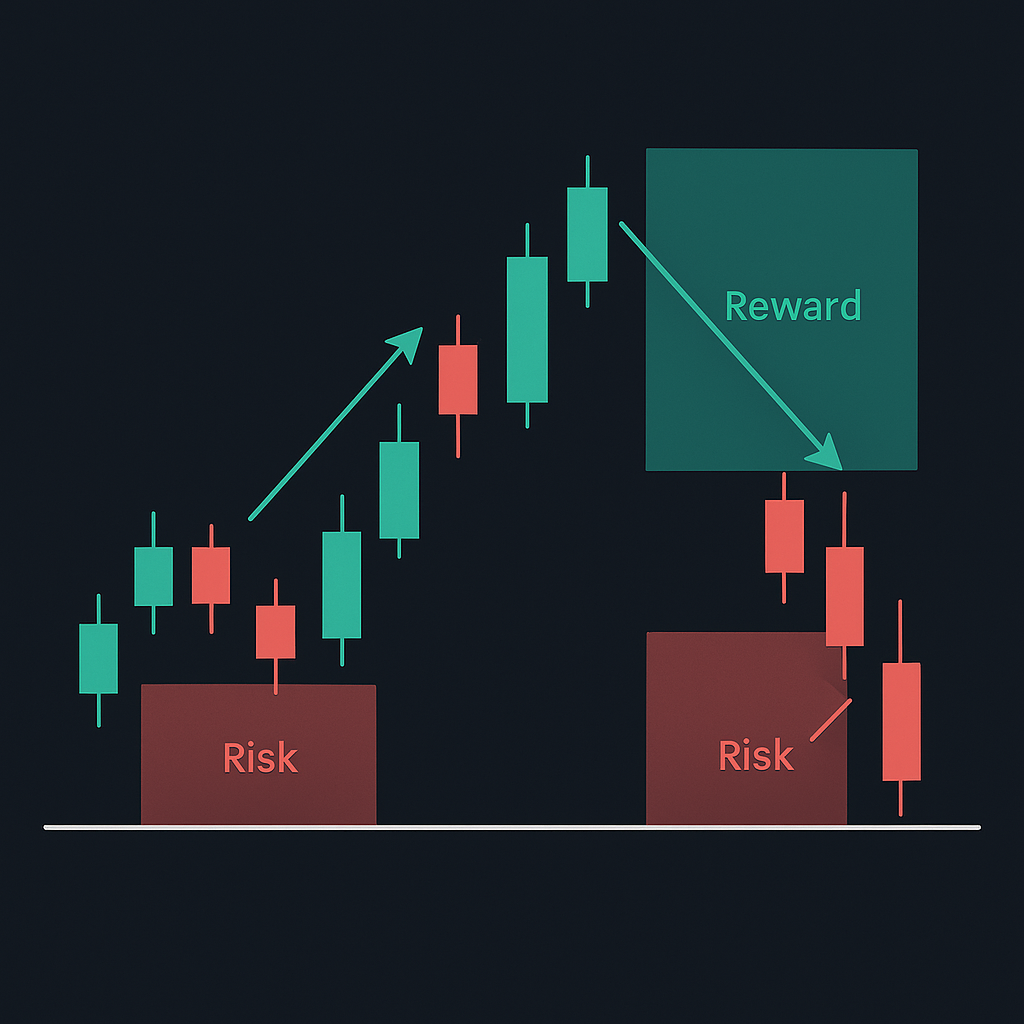

Risk-Reward Ratios: Setting Realistic Targets

The risk-reward ratio is a measure used by traders to compare the potential profit of a trade to its potential loss. A common ratio is 1:2 or 1:3, meaning for every dollar risked, the trader expects to earn two or three dollars.

For instance, if you're trading EUR/USD at 1.0420, and your stop loss is set at 1.0400 (20 pips away), your target should be at least 40 pips away, at 1.0460, to maintain a 1:2 risk-reward ratio.

Why Risk-Reward Ratios Matter

Risk-reward ratios help traders set realistic profit targets and improve their overall trading strategy. They encourage disciplined trading by ensuring that the potential rewards justify the risks taken.

Managing Drawdowns

Drawdowns are inevitable in trading. They occur when your trading account experiences a decline after a losing streak. Managing drawdowns effectively is crucial to long-term trading success.

To minimize drawdowns, consider the following strategies:

- Limit your risk per trade to a small percentage of your account.

- Avoid over-leveraging, which can amplify losses.

- Maintain a diversified portfolio to spread risk.

Diversifying Your Forex Portfolio

Diversification is a key risk management strategy that involves spreading your investments across various currency pairs and financial instruments. By diversifying, you can reduce the impact of a single trade or market movement on your overall portfolio.

Consider incorporating major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as commodities like Gold (XAUUSD) into your trading plan. This approach helps balance risk and provides exposure to different market conditions.

Using Stop Losses and Take Profits

Stop losses and take profits are essential tools for managing risk. A stop loss is an order placed to sell a security when it reaches a certain price, effectively limiting the trader's loss on a position. A take profit is an order that closes a trade once it reaches a certain level of profit.

For example, if you enter a GBP/USD trade at 1.2520, you might place a stop loss at 1.2500 (20 pips) and a take profit at 1.2560 (40 pips), aligning with a 1:2 risk-reward ratio.

Emotional Discipline in Trading

Emotions can significantly impact trading decisions. Fear and greed often lead to poor risk management practices. Maintaining emotional discipline is crucial for sticking to your trading plan and executing risk management strategies effectively.

Mindfulness techniques and regular breaks can help maintain focus and discipline, ensuring that emotions do not cloud judgment.

Implementing a Trading Plan

A well-structured trading plan is a roadmap for your trading activities. It outlines your goals, risk tolerance, strategies, and evaluation metrics. By adhering to a trading plan, you can systematically manage risk and improve your trading outcomes.

Monitoring and Reviewing Your Trades

Regularly reviewing your trades is essential for identifying areas of improvement and ensuring that your risk management strategies are effective. Analyze both winning and losing trades to understand what worked and what didn't.

Keeping a trading journal can be beneficial for tracking your performance and adjusting your strategies as needed.

Conclusion: Achieving Consistent Profits with Risk Management

Forex risk management is the foundation of successful trading. By mastering position sizing, risk-reward ratios, and drawdown management, you can protect your trading capital and achieve consistent profits.

For more personalized support and professional forex signals, explore our Forex Signals services. Our team at BestForexSignals is committed to helping traders of all levels succeed with effective risk management strategies.

FAQs

Q: What is the most important aspect of forex risk management?

A: Position sizing is crucial as it determines the risk level per trade, directly impacting your overall risk exposure.

Q: How do I calculate my risk-reward ratio?

A: Divide the potential profit of a trade by the potential loss to get the risk-reward ratio. Aim for at least a 1:2 ratio.

Q: Why is a trading journal important?

A: A trading journal helps track and analyze trades, allowing for continuous improvement and better risk management.

Q: Can diversification completely eliminate risk?

A: While diversification can reduce risk, it cannot eliminate it entirely. It helps balance risk across different assets.

Forex trading involves significant risk and may not be suitable for all investors. Be sure to practice on a demo account before risking real money. Past performance is not indicative of future results.

Ready to enhance your trading with professional insights? Join our Telegram channel for expert signals and risk management tips. Explore our pricing options to find the plan that suits your needs.