Master Forex Chart Patterns: A Trader's Ultimate Guide

Discover key forex chart patterns like head & shoulders and triangles to boost your trading strategy.

Master Forex Chart Patterns: A Trader's Ultimate Guide

Imagine spotting a price movement that has a high probability of setting up your next profitable trade. What if I told you these setups repeat themselves in the market, offering you countless opportunities? Welcome to the world of forex chart patterns.

TL;DR: Key Takeaways

- Chart patterns are essential for predicting market movements.

- Head and shoulders, double tops, and triangles are key patterns.

- Combining patterns with other indicators improves accuracy.

- Risk management is crucial when trading patterns.

- Practice on demo accounts before live trading.

Introduction to Forex Chart Patterns

Chart patterns are visual representations of market psychology that help traders predict future price movements. Understanding these patterns can give you a significant edge in the forex market, particularly when combined with a solid technical analysis approach.

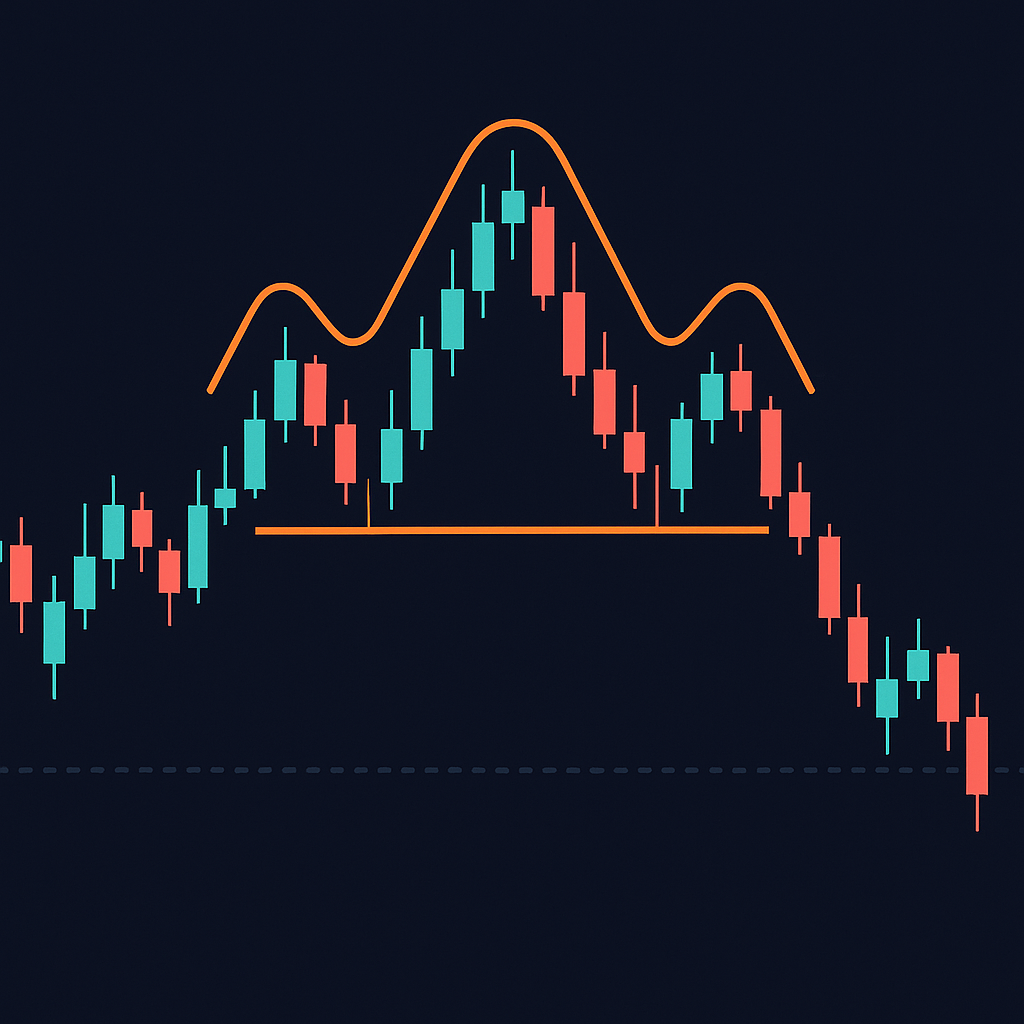

Head and Shoulders Pattern

The head and shoulders pattern is a powerful reversal pattern. It signals a change in trend direction. This pattern consists of three peaks: a higher peak (head) between two lower peaks (shoulders).

Identifying the Pattern

Typically, the pattern forms after an uptrend. The left shoulder is formed with a peak followed by a small correction. The head is a higher peak, followed by another correction. Finally, the right shoulder forms another peak that is generally lower than the head.

Trading the Pattern

To trade this pattern, wait for a breakout below the neckline (a line drawn connecting the lowest points of the two troughs). For example, if EUR/USD forms a head and shoulders with a neckline around 1.0420, a breakout below this level could signal a reversal.

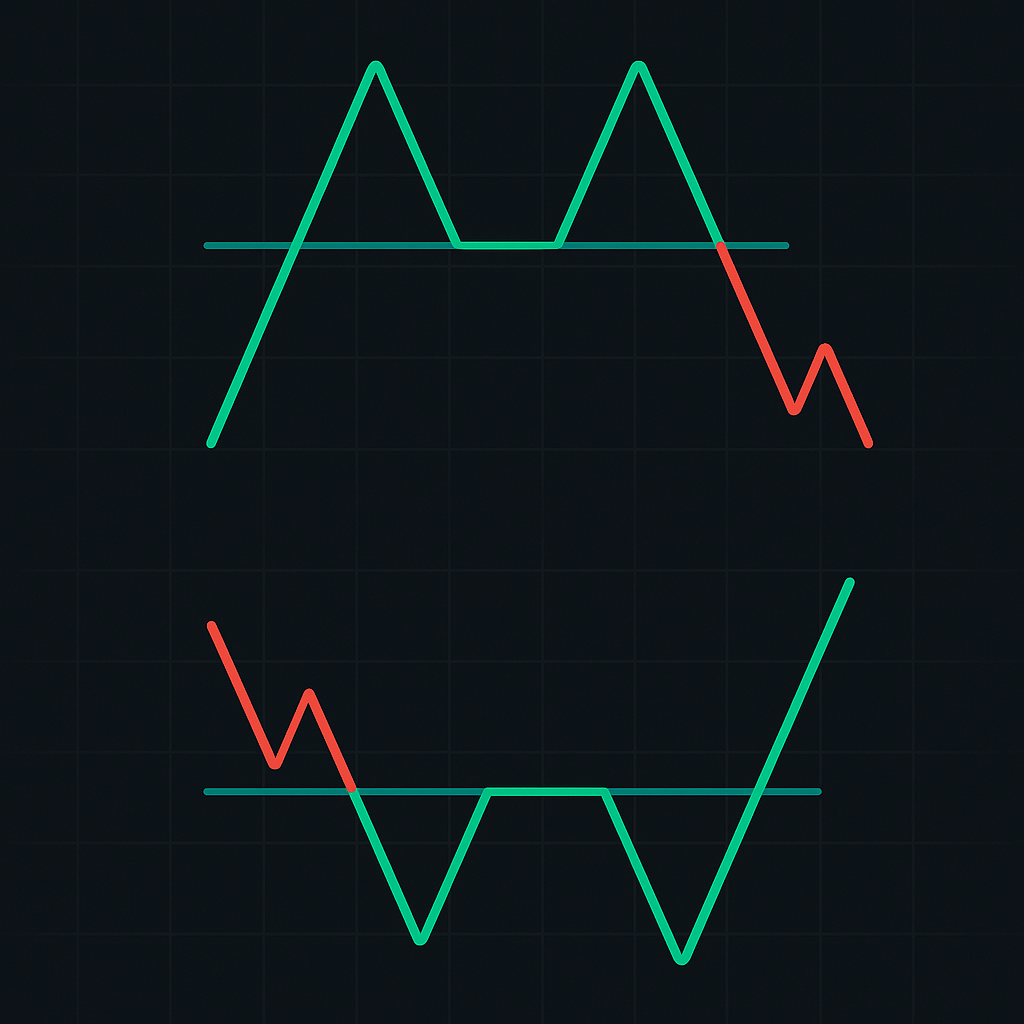

Double Tops and Double Bottoms

These are common reversal patterns. A double top indicates a bearish reversal, while a double bottom signals a bullish reversal.

Identifying Double Tops

A double top occurs when the price forms two peaks at approximately the same level. For instance, if GBP/USD hits 1.2520 twice and fails to break higher, it might be forming a double top.

Trading Double Tops

Look for a break below the support level (formed between the two peaks) to confirm the pattern. Enter short trades below this level with stop-loss orders around 20-50 pips above the peaks.

Triangles: Ascending, Descending, and Symmetrical

Triangle patterns are continuation patterns that can also indicate reversals. Let's explore the three types:

Ascending Triangle

An ascending triangle features a rising lower trendline and a flat upper trendline. It's a bullish pattern often indicating a breakout to the upside. Watch for USD/JPY near 157.50 if it forms an ascending triangle, signaling potential upward movement.

Descending Triangle

This pattern has a descending upper trendline and a flat lower trendline. It usually indicates a bearish breakout.

Symmetrical Triangle

This pattern shows two converging trendlines. It can break out in either direction, so monitoring volume and other indicators is crucial.

Flags and Pennants

Flags and pennants are short-term continuation patterns. They indicate a brief consolidation before the prevailing trend resumes.

Flags

A flag is a rectangular pattern that slopes against the prevailing trend. These patterns can offer attractive risk-reward ratios.

Pennants

Pennants are small symmetrical triangles that form after strong price movements. They indicate a brief consolidation.

Wedges: Rising and Falling

Wedges are similar to triangles but typically indicate reversals. A rising wedge is a bearish pattern, while a falling wedge is bullish.

Trading Rising Wedges

Look for rising wedges during downtrends as they often signal further downside. For example, if gold (XAUUSD) forms a rising wedge at $2660.00, it could indicate a downturn.

Using Chart Patterns in Trading

Successful traders integrate chart patterns with other analysis forms. Consider combining patterns with trend lines, candlestick analysis, and forex signals for better accuracy.

Comparison Table: Key Chart Patterns

| Pattern | Type | Indication |

|---|---|---|

| Head and Shoulders | Reversal | Bearish after uptrend |

| Double Top | Reversal | Bearish after uptrend |

| Double Bottom | Reversal | Bullish after downtrend |

| Ascending Triangle | Continuation | Bullish |

| Descending Triangle | Continuation | Bearish |

Implementing Risk Management with Patterns

Always use stop-loss orders to protect against unexpected moves. For example, place stop-loss 20-50 pips away from your entry point, depending on volatility.

FAQs on Forex Chart Patterns

- What are forex chart patterns? Visual formations on charts indicating potential price movements.

- How reliable are chart patterns? They are more reliable when combined with other indicators.

- Can beginners use chart patterns? Yes, but practice on demo accounts first.

- What is the most common chart pattern? Head and shoulders and double tops/bottoms are very common.

- Do chart patterns work on all timeframes? Yes, but their effectiveness varies.

Risk Disclaimer: Forex trading involves significant risk and is not suitable for all investors. Leverage creates additional risk and loss exposure. Carefully consider your financial situation before trading.

Ready to enhance your trading with professional forex signals? Explore our services at BestForexSignals and join our Telegram channel for real-time insights!